Effortless Tariffs,

Quicker Classifications

Classify quickly with confidence & find the latest duty & tariffs for any import

Duty & Tariffs Calculator

I don't know how you do it, but I am glad I have my HTS Hero!

It was very intuitive and caught something I hadn't seen earlier

Been loving using htshero. Excellent tool and fun watching you develop this.

Trusted by professionals at K+N, DSV, Amazon, and many more...

★Tools That Make Imports Easy

From classification to duty and tarrif calculation — we've got you covered

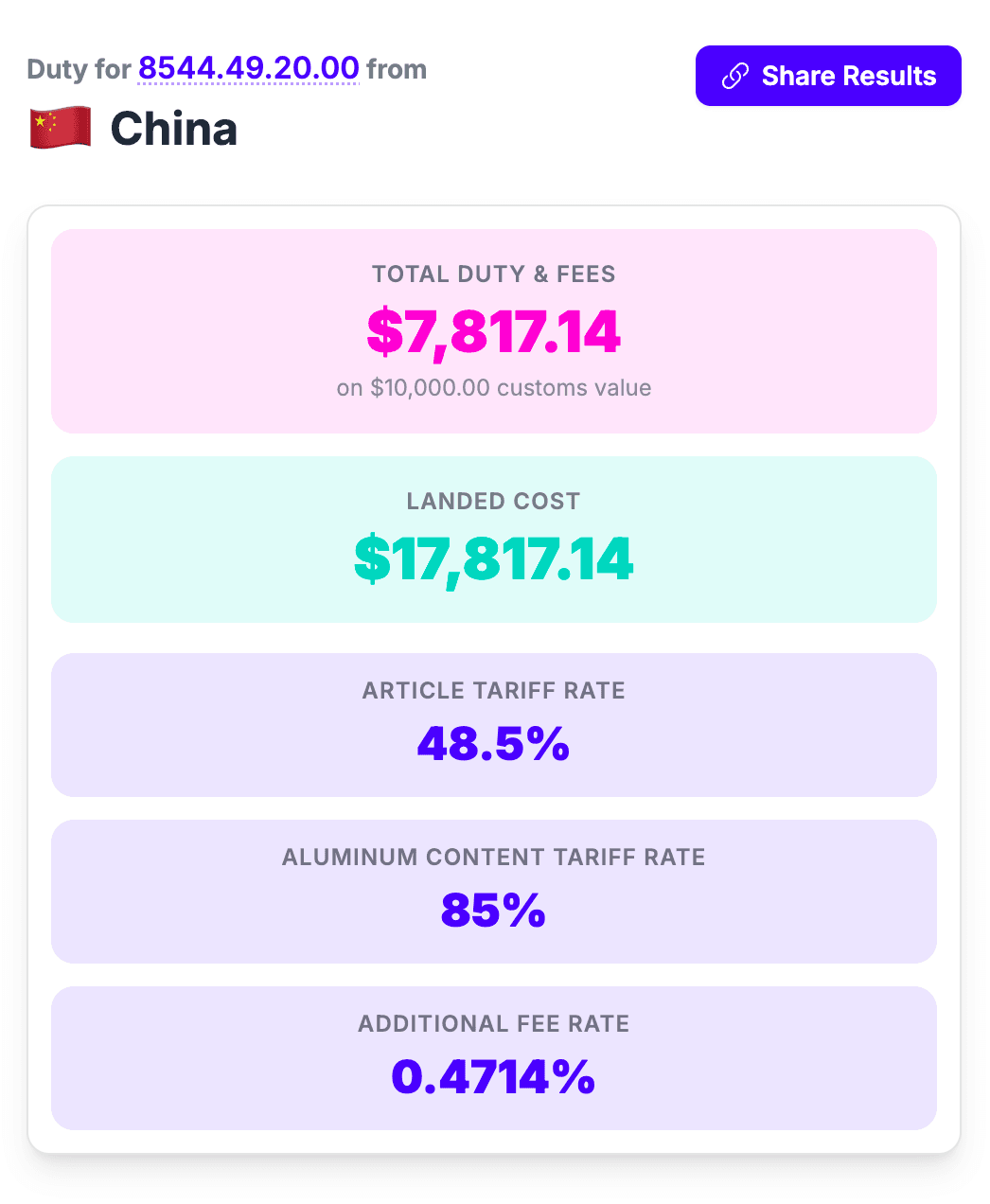

Duty & Tariff Calculator

See the complete tariff & cost breakdown for any US import and discover ways to save with exemptions and special trade programs.

- Know your Costs — See the landed cost, duty rates, and itemized tariffs for any import from any country

- Discover Savings — Find exemptions and trade programs you might be eligible for

- Share Your Results — Share your tariff & duty details with clients and colleagues in a single click

- Stay Up to Date — Updated with the latest tariff announcements, changes, and rules

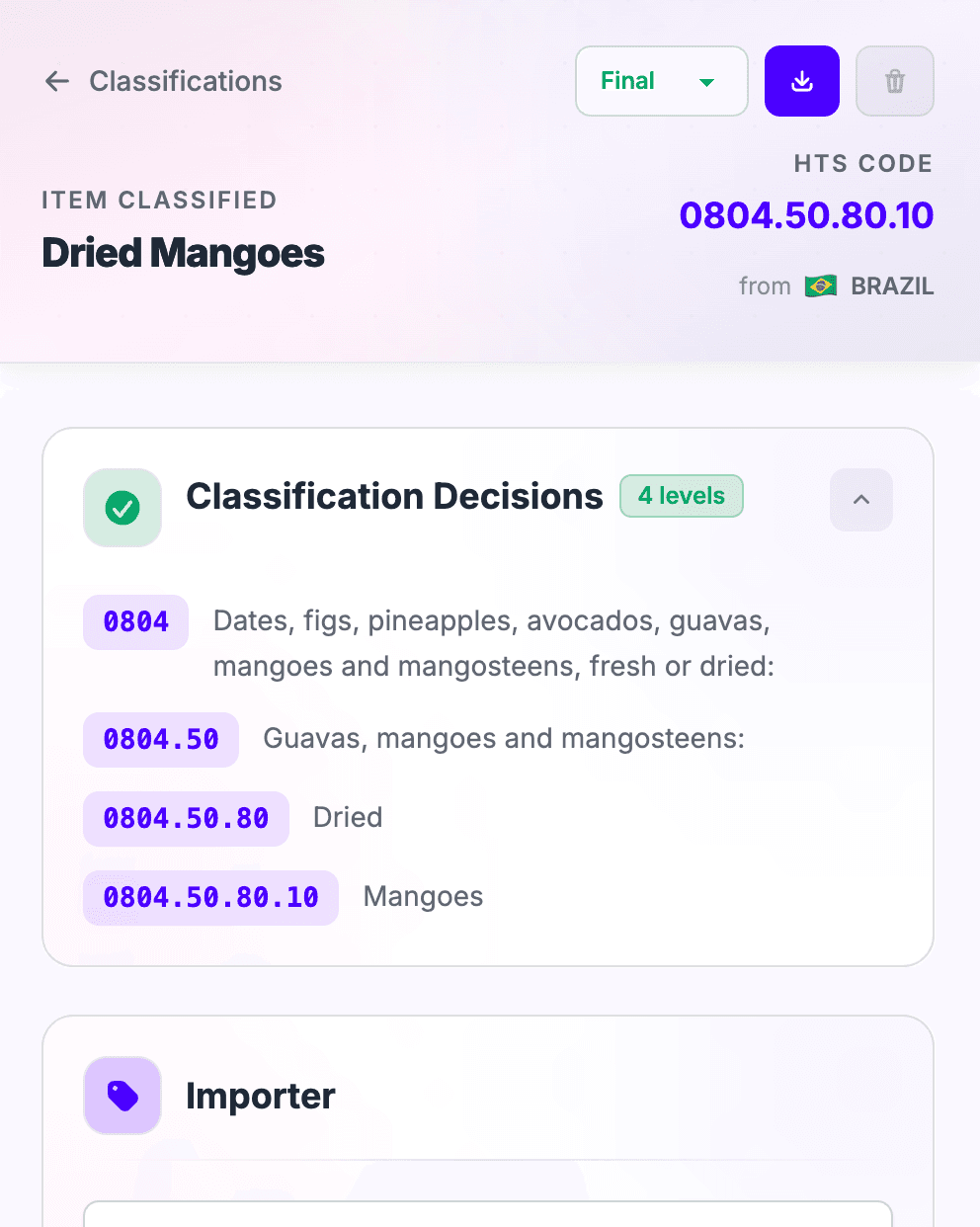

Classification Assistant

Turbocharge your HTS classifications with AI-powered candidate discovery, GRI analysis, cross-rulings validation, and branded advisory reports.

- Quick Candidates — See likely candidate suggestions for any product description

- Best-Fit Analysis — Get a GRI analysis of all candidates, in seconds

- CROSS Validation — See relevant government rulings to validate your classification

- One-Click Reports — Instantly generate branded, professional classification reports

- Bring your Team — See, Review, & Approve Each Others Classifications

Tariff Impact Checker

Instantly see which of your imports are affected by the latest tariff announcements. Get notified before changes hit your bottom line.

- Bulk Checking — Check your entire product catalog against any tariff announcement, all at once

- Intelligent Alerts — Get notified when new tariffs affect any of your imports

- Impact Analysis — See exactly how each tariff change affects your import costs

- Stay Ahead — Know about tariff changes before your next purchase order

Get Your Job Done, Quick

How We Help Customs Brokers

Classify faster, generate client reports instantly, and stay ahead of tariff changes

Quicker Classifications, Instant Duty Quotes, and Zero Tariff Surprises

Premium tools that don't break the bank.

Classify Pro

Smarter Classifications, Effortless Tariffs

- Duty Calculator

- Classification Assistant

- Tariff Impact Checker

Classify for Teams

Streamline Imports with your Entire Team

- Duty Calculator

- Classification Assistant

- Tariff Impact Checker

- Collaborate with your Team

- Comprehensive Team Training

Smarter Classifications Guarantee

If you complete an onboarding session & 20 classifications within 30 days, but are still not satisfied with your experience, we'll refund your purchase in full.

Frequently Asked Questions

Everything you need to know about HTS Hero

Absolutely, you can book a quick demo here.

HTS Hero has 2 main offerings: Classify Pro & Tariff Pro.

Classify Pro is our flagship offering, which includes:

Tariff Pro is purely tariff focused, which includes:

If Tariff help is all you're looking for you can buy Tariff Pro here.

If you're not sure which tool you need, you can always contact us at [email protected]

Absolutely, and we even offer discounts for teams!

HTS Hero was specifically designed to work great for teams.

We have a dedicated team plan that allows your entire team cruise through their import tasks.

You can book a quick demo to learn more about about how HTS Hero can help your team.

Yes!, HTS Hero offers a 10 day free trial for all paid plans!

No credit card required, just sign up and start using the tool!

No problem!

Our Smarter Classifications Guarantee lets you get a full refund if you do 20 classifications and the onboarding session but are still not completely satisfied with your experience after 30 days.

You can cancel your subscription at any time and you will continue to have access until the end of your current billing period.

Just log in to your account, click "Billing" in the profile dropdown, and you'll be able to cancel your subscription.

Classification Assistant helps you classify products dramatically faster, without sacrificing reasonable care or compliance requirements.

We do this through a process we call Coordinated Handoff, where AI and human work together to quickly get the job done right.

The system guides you step-by-step through the HTS hierarchy, surfaces the most relevant classification candidates at every level, and provides clear, structured GRI analysis along the way.

You stay in control of the final decision, with full visibility into the reasoning — so nothing is guessed, automated blindly, or cut short.

Customs brokers and high-volume importers rely on Classification Assistant to catch edge cases, reduce risk, and classify with confidence — even when the answer isn’t obvious.

Duty & Tariff Calculator instantly shows you the duty rates and applicable tariffs for any U.S. import.

Enter an HTS code and country of origin, and we automatically surface the relevant duties, tariffs, and trade programs.

No more jumping between spreadsheets, PDFs, and government websites trying to piece together which tariffs apply, if they stack, and what the landed cost is.

You get a clear, itemized breakdown of duties and tariffs so you can price accurately, spot savings opportunities, and avoid surprises at the border.

You can also share any results with your clients and colleagues in a single click.

Importers, brokers, and logistics teams use the calculator to validate costs fast, discover savings, and make confident decisions before goods ever ship.

Tariff Impact Checker instantly tells you instantly whether new tariff changes affect you or your clients imports.

We continuously monitor tariff announcements then match them against your HTS codes and countries of origin.

When a change impacts your imports, you’re alerted automatically, with a clear explanation of what changed and why it matters.

This lets you react early — adjusting pricing, sourcing, or classifications before higher duties hit your bottom line.

Instead of discovering tariff increases after the fact, businesses use Tariff Impact Checker to stay ahead of risk and protect margins.

Still have questions?

[email protected]