Trusted by Trade Professionals

See The Latest Tariffs

& Exemptions For Any Import

Discover every tariff, exemption, and trade agreement for any import from any country

I don't know how you do it, but I am glad I have my HTS Hero!

It was very intuitive and caught something I hadn't seen earlier

Been loving using htshero. Excellent tool and fun watching you develop this.

Trusted by professionals at K+N, DSV, Amazon, and many more...

★See Tariff Rates

See tariff rates for any import from ~200 countries. Find the country with the best import rate and compare multiple countries at once.

- Global Coverage — See tariffs for any import from ~200 countries

- Find Best Rates — Find the country with the best import rate

- Compare Countries — Compare multiple countries at once

- Auto Stacking — Automatically applies tariff stacking rules

Discover Savings

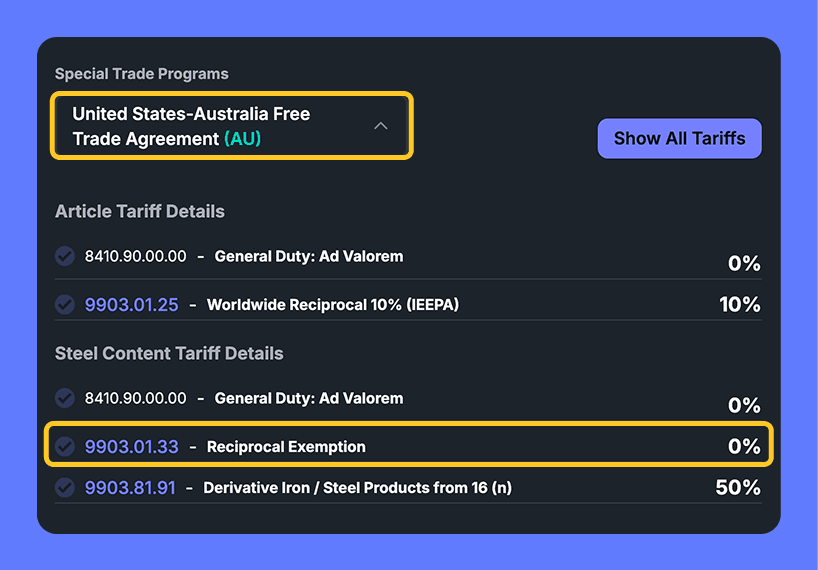

See all the tariff exemptions that might apply and explore free trade programs you may be eligible for.

- Find Exemptions — See all the tariff exemptions that might apply

- Trade Programs — Apply free trade programs you may be eligible for

- Save Money — Reduce your import costs with available savings

Avoid Tariff Surprises

Get notified when your imports are affected by new tariff announcements. Monitor your entire product catalog and know the latest rates before your next purchase order.

- Get Notified — Get alerts when new tariff announcements affect your imports

- Monitor Catalog — Monitor your entire product catalog

- Stay Ahead — Know the latest tariff rate before your next purchase order

Master Tariffs & Discover Savings

Join 200+ importers & customs brokers who are conquering tariff chaos with HTS Hero

Starter

See if your imports are affected by tariffs

- Unlimited Tariff Impact Checks

See if your imports are affected by new tariff updates

- Product Catalog

Upload your imports and quickly check them against new tariff announcements

Standard

24/7 Tariff Monitoring for Your Imports

- Unlimited Tariff Impact Checks

See if your imports are affected by new tariff updates

- Product Catalog

Upload your imports and quickly check them against new tariff announcements

- Tariff Monitoring for your Imports

Get notified when your imports are affected by new tariffs

Pro

Master Tariffs & Find Ways to Save

- Unlimited Tariff Impact Checks

See if your imports are affected by new tariff announcements

- Product Catalog

Upload your imports and quickly check them against tariff updates

- Tariff Monitoring for your Imports

Get notified when your imports are affected by new tariffs

- Duty Calculator

See the tariffs, duty rates, & exemptions for any item from any country

Tariff Pro for Teams

Get Pro for your whole team with custom pricing and dedicated support.

See How it Works

A quick demo so you know exactly what you'll get

More Tariffs are Coming

Quickly knowing your impacts can mean big savings

Be Prepared Today