The End of De Minimis

Imports below $800 are no longer exempt from taxes or tariffs... But what's the new rate?

Introduction

On August 29th the United States ended the "de minimis" exemption for imports below $800.

This means that imports below $800 are now subject to taxes or tariffs.

What tariffs you might ask? Here's the breakdown:

Details

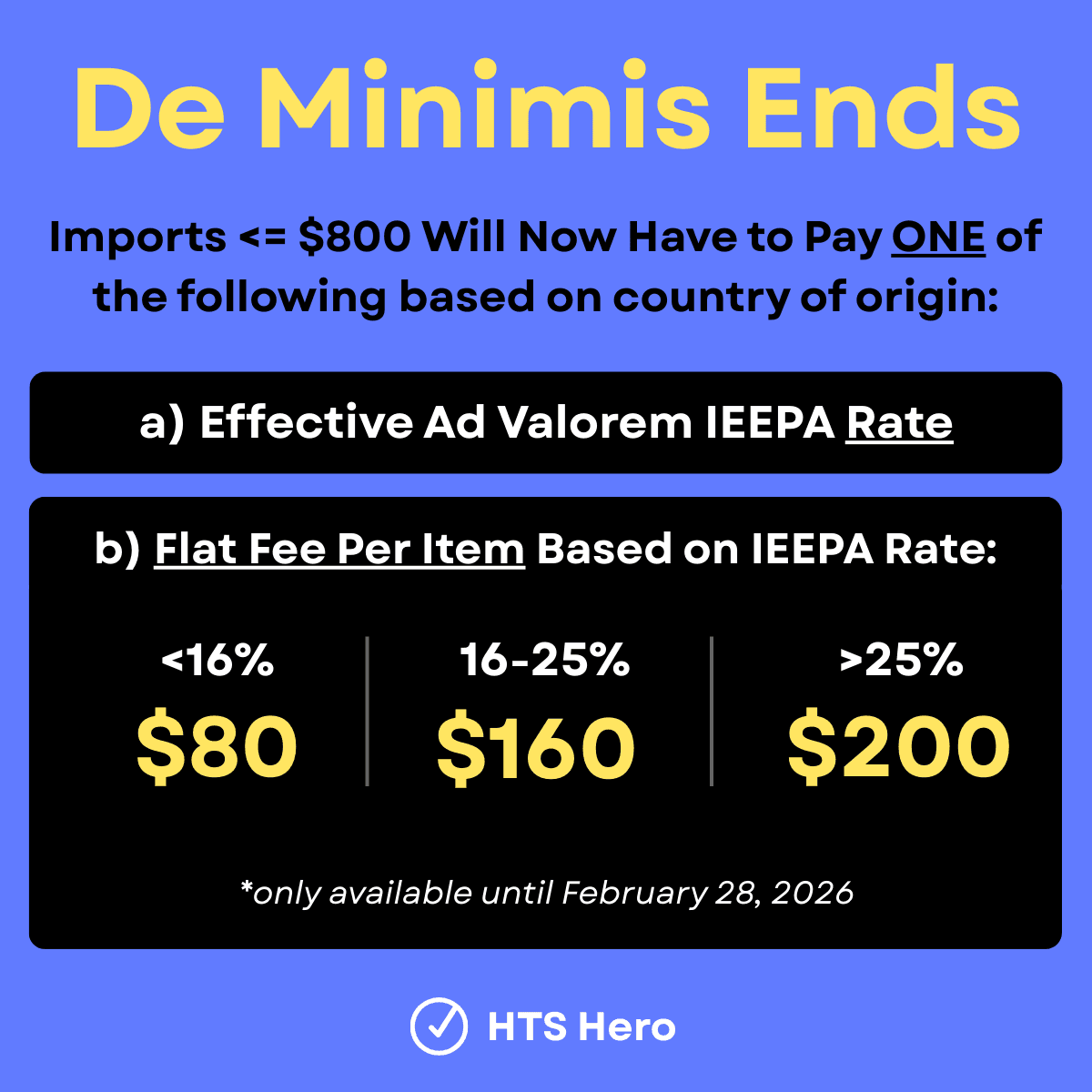

Imports <= $800 Will Now Have to Pay ONE of the following based on country of origin:

A) Effective Ad Valorem IEEPA Rate

B) Flat Fee Per Item Based on IEEPA Rate:

Less than 16%: $80/item

16-25%: $160/item

Greater than 25%: $0/item

Effective: August 29th, 2025

Source: Chapter 99, Subchapter III, Note 2(y)

Struggling to Keep Up With Tariff Changes?

Keeping track of the growing number of tariffs and exemptions that apply to any import has become overwhelming.

To quickly check if an import is affected by new tariffs checkout our free Tariff Impact Checker.

Get Notified Tariffs Affect your Imports

Posted by

Related reading

New Articles Exempt from Reciprocal Tariffs

Hundreds of articles are now exempt from the reciprocal tariff

China Tariff Exemption Have Been Extended

The United States has extended two tariff exemptions on imports from China

India Hit with 25% Tariff for Russian Oil Use

India has been hit with an additional 25% tariff for their use of Russian oil. This is a retaliatory measure by the United States to address 'threats' from Russia.