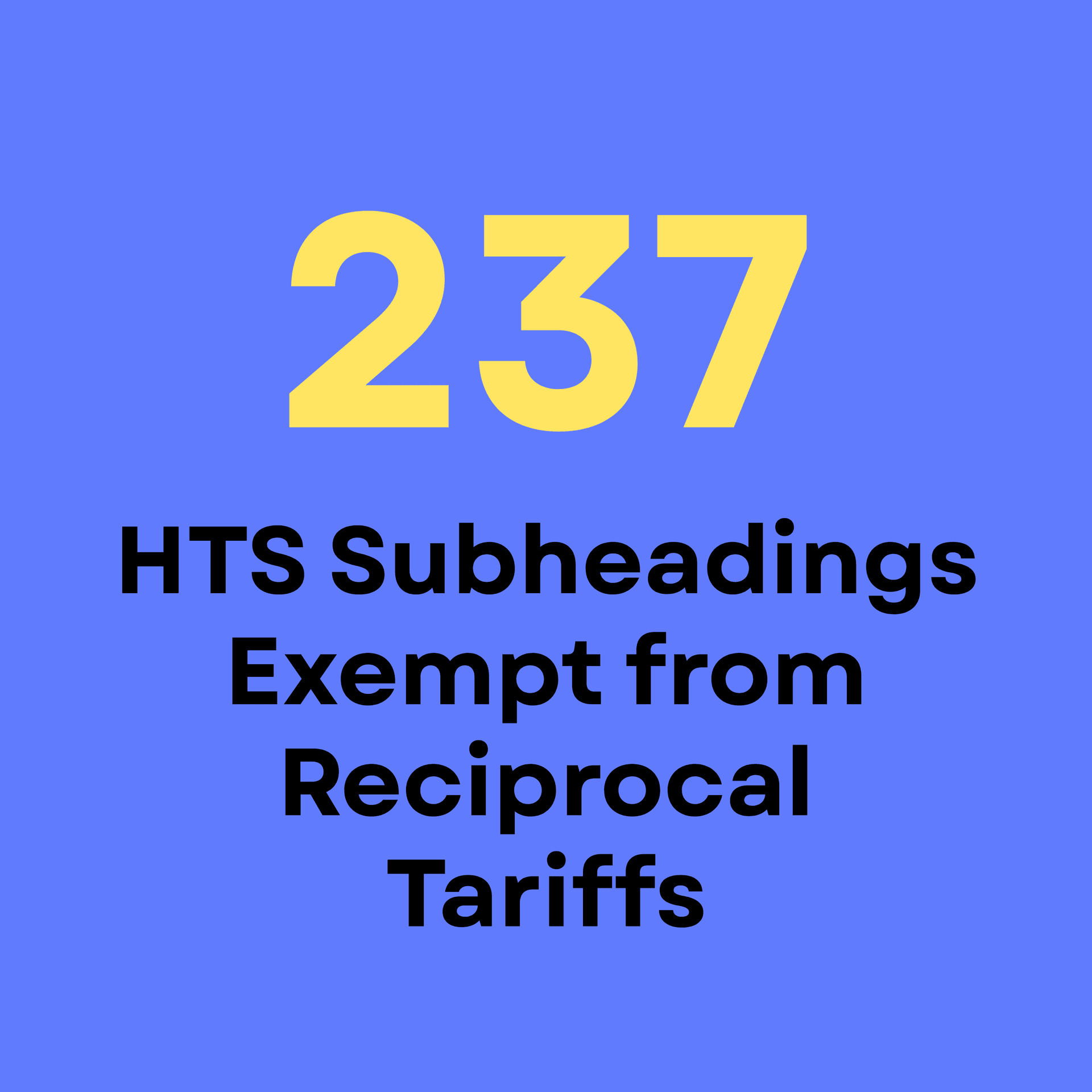

New Articles Exempt from Reciprocal Tariffs

Hundreds of articles are now exempt from the reciprocal tariff

On November 13th the United States added 237 additional subheadings to the list of articles that are exempt for the reciprocal tariff.

Additionally, there were 11 special items mentioned that are also be exempt from reciprocal tariffs, but other items in the same subheading are not.

Meaning, not all articles that fall under the same HTS Subheading as them qualify for the exemption as well.

What this boils down to is that if you classify an item that falls under one of those subheadings, it may or many not actually be exempt, based on its own description.

The full list of the items, and their matching subheadings is below for your future reference:

- 0805.90.01 - Only Etrogs

- 0811.90.80 - Only Tropical fruit, nesoi, frozen, whether or not previously steamed or boiled

- 1404.90.90 - Only Date palm branches, Myrtus branches or other vegetable material, for religious purposes only

- 1905.90.10 - Only Bread, pastry, cakes, biscuits and similar baked products, nesoi, and puddings, whether or not containing chocolate, fruit, nuts or confectionery, for religious purposes only

- 1905.90.90 - Only Bakers’ wares, communion wafers, sealing wafers, rice paper and similar products, nesoi, for religious purposes only

- 2008.99.21 - Only Acai

- 2009.31.60 - Only Citrus juice of any single citrus fruit (other than orange, grapefruit or lime), of a Brix value not exceeding 20, concentrated, unfermented, except for lemon juice

- 2009.89.70 - Only Coconut water or juice of acai

- 2009.90.40 - Only Coconut water juice blends, not from concentrate, packaged for retail sale

- 2106.90.99 - Only Acai preparations for the manufacture of beverages

- 3301.29.51 - Only Essential oils other than those of citrus fruit, nesoi, for religious purposes only

Struggling to Keep Up With Tariff Changes?

Keeping track of the growing number of tariffs and exemptions that apply to any import has become overwhelming.

To find the latest correct tariffs for any import from any country, checkout our Duty Calculator. All you need to do is plug in your HTS code and you will see every tariff that could apply to that item.

To quickly check if an import is affected by new tariffs, you can use our Tariff Impact Checker.

Posted by

Related reading

Imports below $800 are no longer exempt from taxes or tariffs... But what's the new rate?

China Tariff Exemption Have Been Extended

The United States has extended two tariff exemptions on imports from China

India Hit with 25% Tariff for Russian Oil Use

India has been hit with an additional 25% tariff for their use of Russian oil. This is a retaliatory measure by the United States to address 'threats' from Russia.